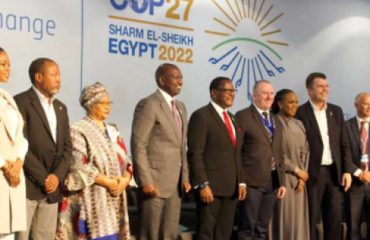

Climate finance for the African continent got a boost at the 2022 United Nations Climate Conference (COP27), with the launch of the African Carbon Markets Initiative. This aims to make climate finance available for African countries, expand access to clean energy and drive sustainable economic development, writes Jonathan Colmer for The Conversation.

Carbon markets offer an incredible opportunity to unlock billions for the climate finance needs of African economies while expanding energy access, creating jobs, protecting biodiversity, and driving climate action. However, Africa currently produces only a tiny percentage of its carbon credit potential. Kenya, Malawi, Gabon, Nigeria, and Togo have already indicated their intention to collaborate with the market.

Climate projects include reforestation and forest conservation, investments in renewable energy, carbon-storing agricultural practices, and direct air capture. In return for funding projects like these, investors receive carbon credits – certificates used to “offset” the emissions that they continue to produce.

The African initiative’s goal is to produce 300 million new carbon credits annually by 2030, comparable to the number of credits issued globally in voluntary carbon offset markets in 2021. However, there is considerable skepticism about whether carbon offset credits do mitigate climate change.